Does Your Business Software Arrange e-Way Bill Automation?

In the current world, e-Way bill automation is one of the most important things that you need to have in your business software. E-way bill automation will help you a lot in managing your entire logistics and transport business.

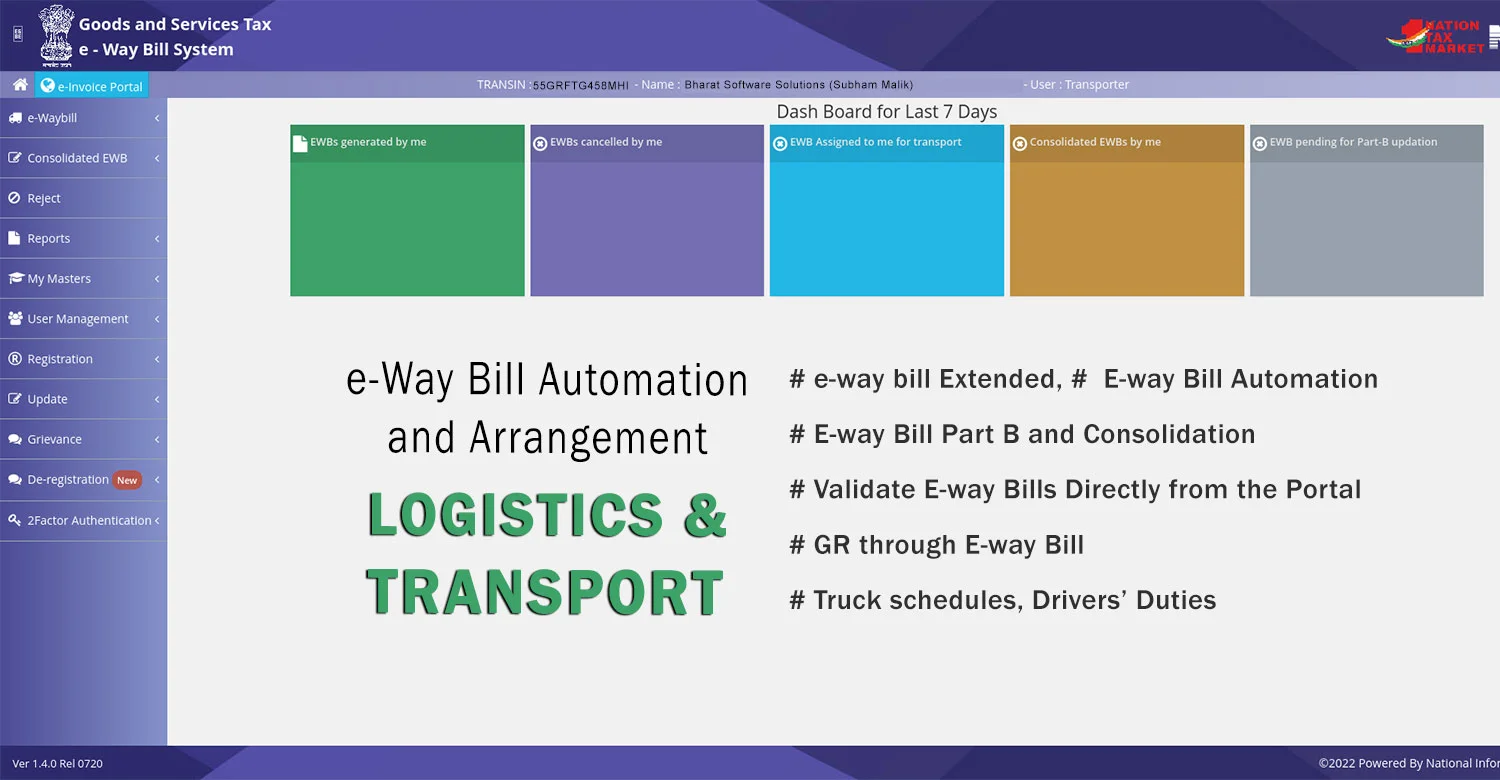

Bharat Software Solutions (BSS) allows you to fully manage the logistics operation and automate E-way bills directly with the help of the software. You can easily track shipments as well as you can optimize routes. All these will help you in increasing your revenue as well as in making the efforts easier and faster.

Now, let’s talk about E-way bill automation. There are multiple features with the E-way bill automation that you will get here. You can use all the modules to make sure that your invoices and bills from transport goods across India are properly optimized.

- e-Way Bill Extended

- e-Way Bill Automation

- e-Way Bill Part B and Consolidation

- GR Through e-Way Bill

Call us:

Book a Demo

(a) Complete E-way Bill Automation

The first feature you will get here is the complete E-way bill automation. The complete E-way bill automation allows the logistics and transport companies to process the whole bill with just a couple of clicks with the help of an automated process.

E-way bills are one of the most important legal documents that you need to have if you are transporting goods. Generating the bills takes a lot of time and there could also be many errors which may result in worse consequences.

With the help of automated software, you can generate E-way with just a couple of clicks. BSS has the features to enter all the details such as shipments and inventory. You can simply enter all the details and then the E-way bill will help you generate the bull.

Additionally, the system can generate both Part A (basic details) and Part B (vehicle details). So, you don’t need to worry about anything when if you have the feature of complete E-way bill automation.

(b) E-way Bill Automatic Extension

The E-way Bill Automatic Extension feature is yet another feature that will help your shipments stay compliant with regulations during transportation. If your shipments exceed the initial validity period, you can simply make use of an E-way bill automatic extension.

In many cases, the E-way bill expires and you will need more time. In that case, you can surely use the extension to extend the period. This whole process is done automatically.

Yes, BSS automatically calculates if the extension is needed. If it’s needed, it will automatically apply for the E-way bill extension.

It’s beneficial when facing unexpected transit delays. In India, there are many instances when the goods can be delayed. So, no matter if the vehicle broke down or there are some other problems, you can rely on Bharat Software TMS to automatically extend your E-way bill.

The whole documentation is carried out as per the Indian tax regulations.

(c) E-way Bill Part B and Consolidation System

E-Way Bill Part B and Consolidation System help you to manage multiple goods under a single e-Way Bill.

As you know, the Part B of the e-Way Bill refers to the details of the vehicle or transporter carrying the goods.

So, you can simply input, update, and manage the details of the vehicles. Thanks to our TMS fleet management feature, you can do this automatically. You simply need to select the fleet that you want to have and then it will generate a single e-Way bill for you.

If you are transporting huge shipments, this feature is much more useful. With this, you can ensure that all your goods are properly tracked as well as the billing of the same goods is done in the proper accurate way. As the software is automated, you won’t have to worry about human error.

Part B of the e-Way bill is sometimes way more difficult as you need to fill out the information about the vehicles as well. So, automating it will save you a lot of time.

Not to mention, you will also get additional features to manage the vehicles individually. So, it will not only help you with the Part B of the e-Way bill but you can also use the same features to make the maximum use of the fleet to maximize your revenue.

(d) Create GR through e-Way Bill

Once you are done with the e-Way bill generation process, you will have to go to the next step. The receipt is needed and can be automatically generated with our logistics and transport management software. It maintains proper alignment between the transportation documents and inventory management.

By directly linking GRs to E-way Bills, businesses will have proper accuracy in maintaining these documents. With this, you can make sure that there is proper transparency with all the Indian GST regulations.

When it comes to logistics and Transport Management Software by Bharat Software Solutions, we have specific features for Indian logistics and transport companies. So, you will get the features for GST and other important bills in our TMS.

The goods receiving (GR) is automated and filled with the right data which are fetched directly from the software. As the software already has the fields to enter all the relevant data, you can easily make the arrangements and automate the e-Way bills.

It will save you a lot of time in the whole process. Also, the data entry work can be boring which also leads to many errors. So, automating GR will fully remove the errors you are getting.

Further, it will also help you in the validation. You don’t need to open different tabs to verify and validate the data generated in the E-way bill. Let’s talk more about the same.

(e) Validate e-Way Bills Directly from the Portal

You can easily Validate e-Way Bills Directly from the Portal. When it comes to validating the e-Way bills, you can easily do with from the portal itself. As you already know, you need to validate the e-Way bills directly from the software.

The manual checks take a lot of time. Instead you can automate the whole process and let the software do the validation work. Usually, you will have to open a few tabs to do the whole verification process. However, with the software, you can easily complete it with the help of the portal.

Yes, it has direct integration with the GST portal. As we have mentioned our TMS works by Indian laws, you can easily validate it with the government’s database.

That’s the best part about our software. You don’t need to manually do things here. Instead, you can fully automate the whole work. So, instead of manually filling this data, you can simply automate the whole process.

This will remove most of the work from your end.